idaho sales tax rate lookup by address

Maximum Possible Sales Tax. This is the total of state county and city sales tax rates.

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

Some but not all choose to limit the local sales tax to lodging alcohol.

. Idaho has a 6 statewide sales tax rate but also has 116 local tax jurisdictions including. Local level non-property taxes are allowed within resort cities if. ZIP--ZIP code is required but the 4 is optional.

Apply more accurate rates to sales tax returns. The minimum combined 2022 sales tax rate for Idaho Falls Idaho is. Exact tax amount may vary for different items.

Sales tax rates in Idaho are destination-based meaning the sales tax rate is based or. The minimum combined 2022 sales tax rate for Idaho City Idaho is. Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0.

Idaho has a statewide sales tax rate of 6 which has been in place since 1965. With local taxes the total sales tax rate is between 6000 and 8500. Depending on local municipalities the total tax rate can be as high as 9.

What is the sales tax rate in Idaho Falls Idaho. Object Moved This document may be found here. The idaho id state sales tax rate is currently 6.

Please ensure the address information you input is the. The Idaho sales tax rate is currently. Average Local State Sales Tax.

No other municipality can add sales taxes on top of the state rate. The Idaho sales tax rate is 60. Also the Idaho State Tax Commission sets property tax values for operating property which consists mainly of public utilities and railroads.

Local tax rates in Idaho range from 0 to 3 making the sales tax range in Idaho 6 to 9. Most homes farms and businesses are. 31 rows Idaho Falls ID Sales Tax Rate.

Type an address above and click Search to find the sales and use tax rate for that location. Jerome ID Sales Tax Rate. Get information about sales tax and how it impacts your existing business processes.

The County sales tax. The Idaho ID state sales tax rate is currently 6. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax.

Find your Idaho combined state and local tax rate. Purchase Location ZIP Code -or- Specify Sales Tax Rate. The base state sales tax rate in Idaho is 6.

Los Angeles Sales Tax Rate And Calculator 2021 Wise. Quickly learn licenses that your business needs and. This is the total of state county and city sales tax rates.

2022 Idaho state sales tax. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Use this search tool to look up sales tax rates for any location in Washington.

Dmv Idaho Transportation Department

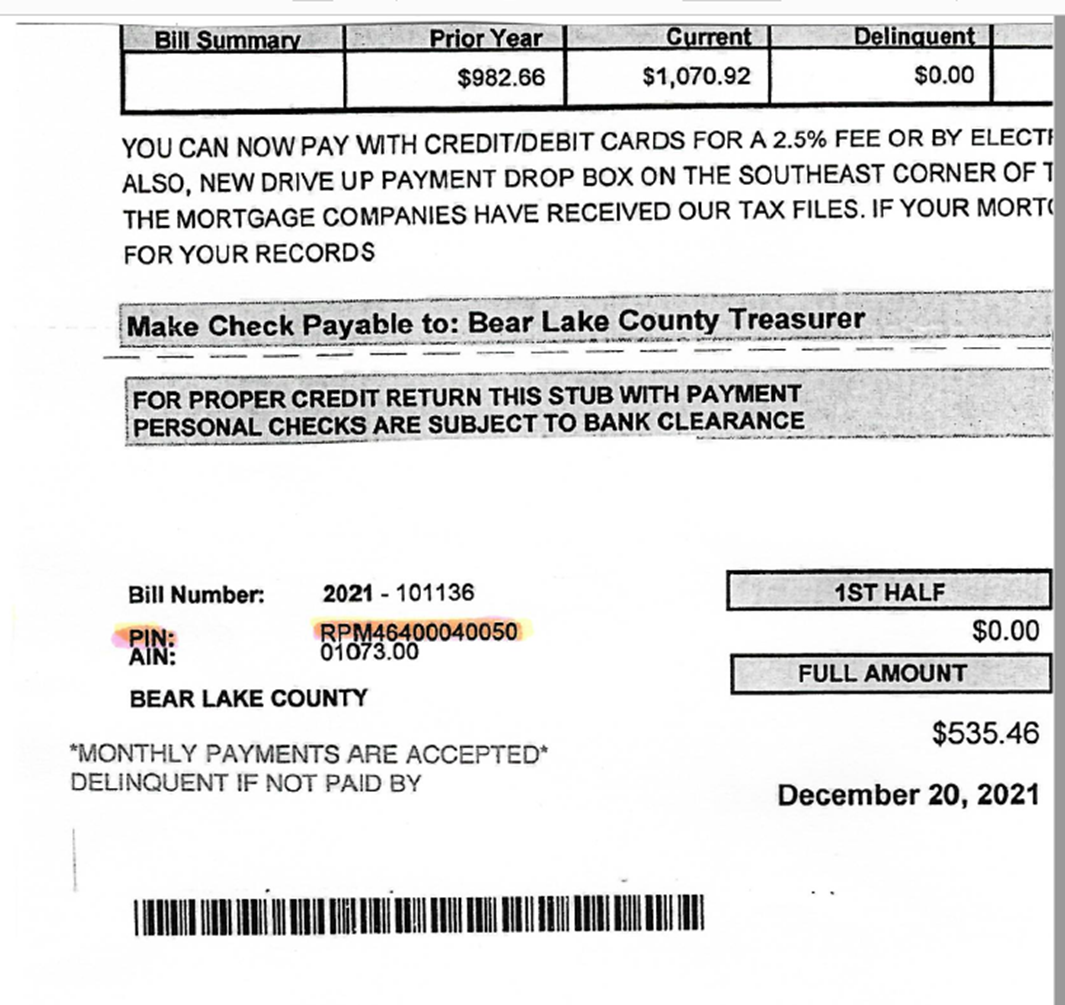

Bear Lake County Treasurer Bear Lake County Idaho

How To Charge Your Customers The Correct Sales Tax Rates

State And Local Sales Tax Rates Sales Taxes Tax Foundation

Idaho Sales Tax Guide And Calculator 2022 Taxjar

How To File And Pay Sales Tax In Idaho Taxvalet

Idaho Sales Tax Calculator Reverse Sales Dremployee

Idaho Sales Tax Rates By City County 2022

Sales Tax Calculator And Rate Lookup Tool Avalara

Property Tax Calculator Estimator For Real Estate And Homes

Stripe Tax Automate Tax Collection On Your Stripe Transactions

Idaho Property Tax Calculator Smartasset

Treasure Valley Subaru Subaru Dealership In Nampa Id

Idaho Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikipedia

Kootenai County Property Tax Rates Kootenai County Id

As Tax Gap Widens Idaho 1 Of 10 States With No Obligation To Disclose Property S Sale Price Idaho Capital Sun